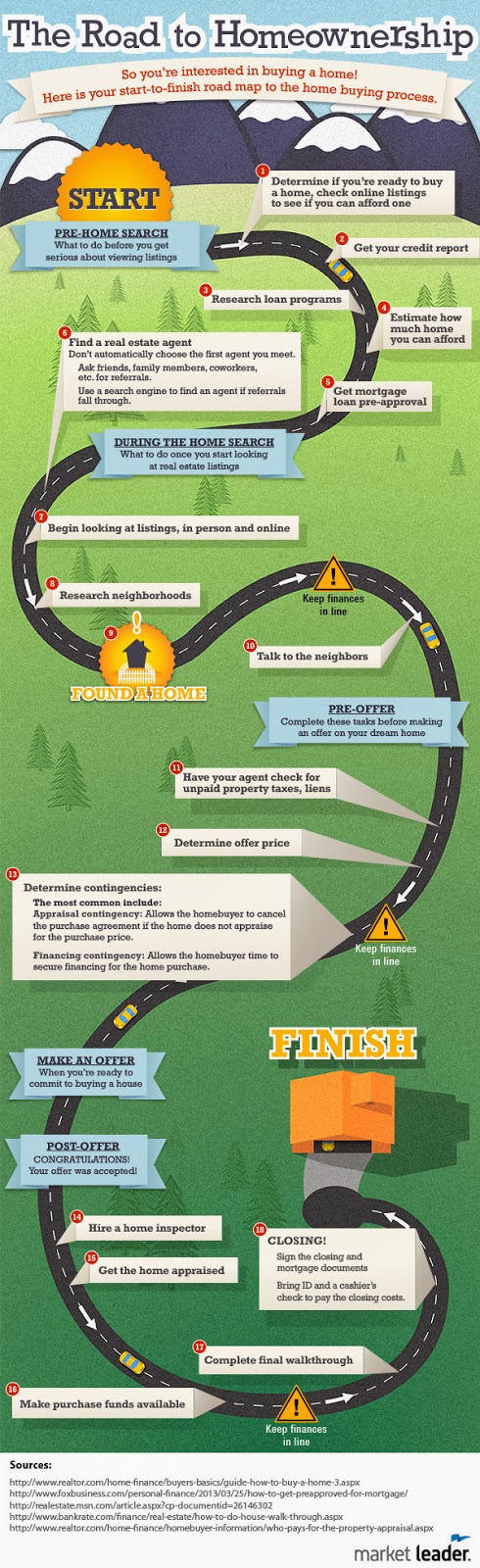

“Now that I have pulled my credit

score and I qualify for a mortgage loan what do I do next?!” That’s a great

question! The best place to start is with doing some more research. It is

always best to be informed before you make any more big decisions. That brings

us to your next step on the road to home ownership: Step #3. “Research Loan Programs”. You want to

make sure you get the help you need to make your home buying dreams come true

and there might be a loan program out there that could help!

Below is

more information about different loan programs. Make sure you get in touch with

your mortgage professional to learn more and see what their specific company

offers. Jeff Chrast, with Marketplace Home Mortgage, is extremely knowledgeable

and works harder than ever to get you a loan that best fits your specific

needs. Get in contact with Jeff himself, or your own Jeff, and ask some follow up

questions regarding the following:

FHA-insured

loan: FHA stands for Federal Housing Administration. FHA-insured loans are a

type of federal assistance that permits lower income Americans to borrow the

money they need for the purchase of a home that they would not have otherwise

been able to afford.

VA

loan: A VA loan is a mortgage loan that is available to American veterans or

their surviving spouses guaranteed by the U.S. Department of Veterans Affairs.

The loan allows veterans to purchase a home with no down payment.

Rural

development programs: Rural Housing loans are easy to quality for and allow for

less than perfect credit. If you have past credit problems it is possible that

you will still quality for a Rural Housing loan. Most programs, including one

offered through Marketplace Home Mortgage, offers financing to low income

Americans who are buying in rural areas with no down payment and lowest monthly

mortgage insurance available.

These

are some great options to continue researching further and to ask follow up

questions to with your Loan Officer. After you know what loan or program you

qualify for you can move onto the next step – Estimating How Much You Can

Afford! Check back later to learn more about step #4 on the Road to Home

Ownership!

No comments:

Post a Comment